Dairy-RP Participation Update – 10/29/18

Executive Summary

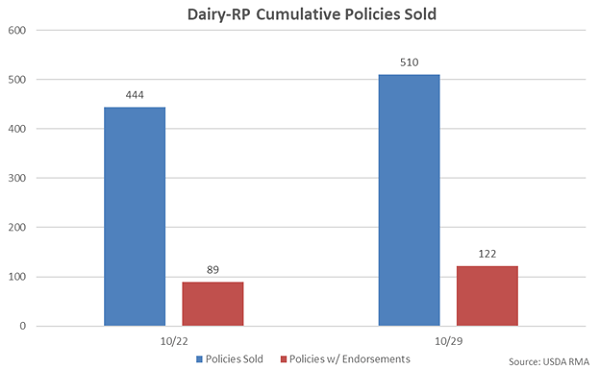

Dairy Revenue Protection (Dairy-RP) participation figures provided by the USDA Risk Management Agency (RMA) were recently updated with values spanning through the final week of October. Highlights from the most recent report include:

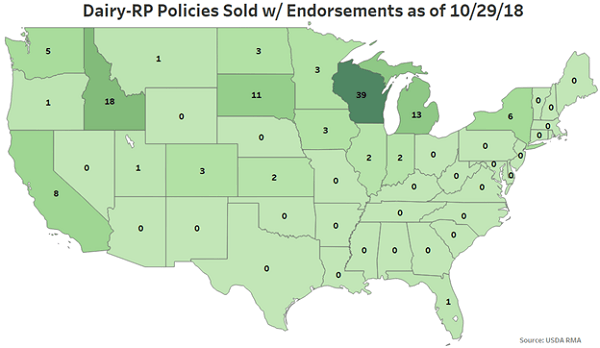

- There were 510 Dairy-RP policies sold through the week ending Oct 26th, with 122 of the policies having active endorsements. Wisconsin led all states in the number of policies sold with active endorsements, followed by Idaho and Michigan.

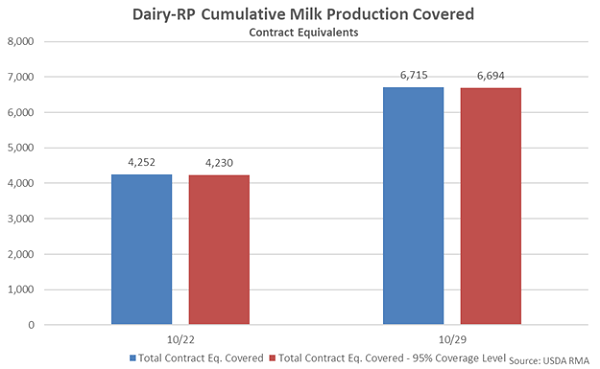

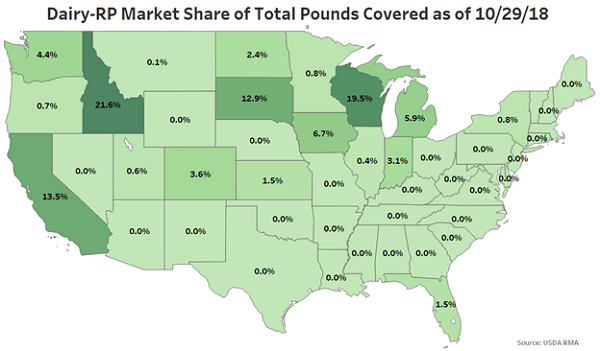

- Dairy-RP policies sold through the week ending Oct 26th have covered a total of 1.34 billion pounds of milk, the equivalent of approximately 6,700 Class III milk contracts but just 0.6% of total 2019 USDA projected milk production volumes.7% of all milk covered has been at the 95% coverage level. Idaho has led all states in pounds of milk production covered within the Dairy-RP program through the week ending Oct 26th, followed by Wisconsin and California.

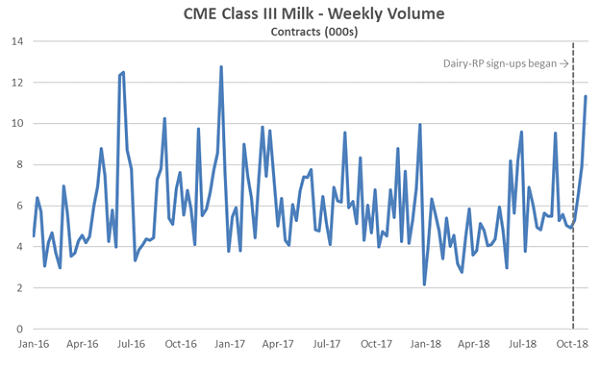

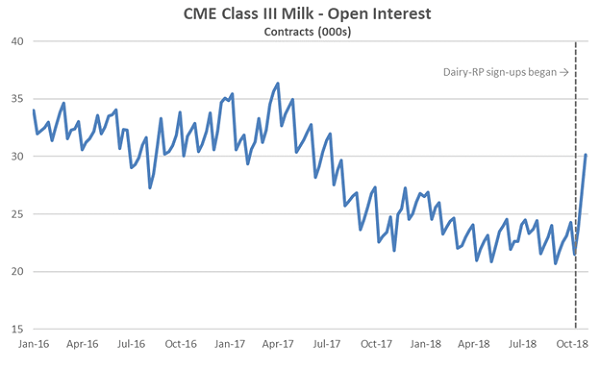

- CME Class III Milk open interest and volume figures have increased substantially since Dairy-RP sign-ups began on Oct 9th, reaching 15 and 22 month highs, respectively, through the week ending Oct 26th.

Additional Report Details

Policies Sold:

There were 510 Dairy-RP policies sold through the week ending Oct 26th, up 66 from the previous week. Of the policies sold, 122 had active endorsements through the week ending Oct 26th, up 33 from the previous week.

Dairy-RP policies have been sold throughout 28 states through the week ending Oct 26th. Policies with active endorsements have been sold throughout 18 states, led by Wisconsin, Idaho and Michigan. Wisconsin has accounted for nearly one third of all policies sold with active endorsements through the week ending Oct 26th.

Pounds Covered:

Over 1.34 billion pounds of milk have been covered through the Dairy-RP program through the week ending Oct 26th, which is the equivalent of approximately 6,700 Class III milk contracts. 99.7% of all milk production covered has been at the 95% coverage level through the week ending Oct 26th.

Idaho has led all states in pounds of milk production covered within the Dairy-RP program through the week ending Oct 26th, followed by Wisconsin and California.

CME Volume & Open Interest:

CME Class III Milk open interest and volume figures have increased substantially since Dairy-RP sign-ups began on Oct 9th, reaching 15 and 22 month highs, respectively, through the week ending Oct 26th.

Dairy-RP milk production volumes covered through the week ending Oct 26th are equivalent to just 0.6% of total 2019 USDA projected milk production volumes. For comparison, CME Class III Milk open interest as of the week ending Oct 26th was equivalent to 2.7% of 2019 projected production volumes.

LET’S CHAT

Send us a message below or give us a call at

800.884.8290

Stay Updated

Subscribe to our newsletter

for more updates and information

Stay Updated

Subscribe to our newsletter

for more updates and information

HELPFUL LINKS

CONTACT US

Toll Free: 800.884.8290

Fax: 815.777.3308

11406 US Route 20 West

PO Box 6622

Galena, IL 61036

HELPFUL LINKS

CONTACT US

Toll Free: 800.884.8290

Fax: 815.777.3308

11406 US Route 20 West

PO Box 6622

Galena, IL 61036

Atten Babler Insurance Services LLC is an equal opportunity provider and employer.

The U.S. Department of Agriculture (USDA) prohibits discrimination against its customers, employees, and applicants for employment on the bases of race, color, national origin, age, disability, sex, gender identity, religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual’s income is derived from any public assistance program, or protected genetic information in employment, or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities.)

This publication is brought to you by Atten Babler Insurance Services LLC and is intended for informational purposes only. Nothing contained herein can or should be interpreted to take precedence over policy language. Federal Crop Insurance Corporation/Risk Management Agency regulation, and Underwriting or Loss Adjustment rules.