The following article was recently featured in Hoard’s Dairyman

The market collapse was not a “black swan” event

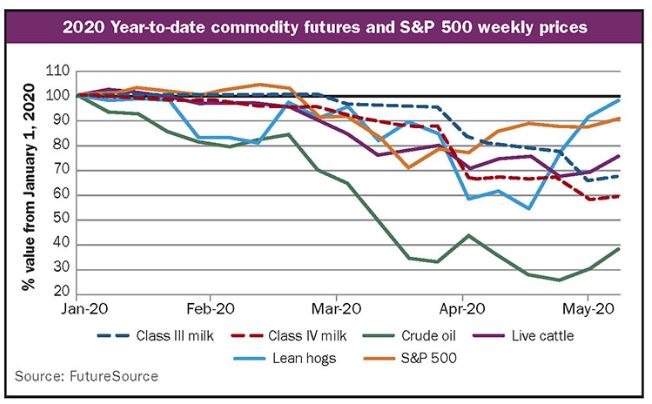

The coronavirus pandemic is a once in a generation event that has wreaked havoc on the dairy market. Prices have collapsed, supply chains are damaged, and milk dumping has tragically become widespread. Producers, processors, restaurateurs, and consumers are all experiencing financial stress, disruption, and anxiety.

In a stress event, it is important to reflect on what should have been anticipated and what could not have been anticipated. Understanding these points of distinction can help dairy producers enact a risk management plan to avoid trouble in the future.

The pandemic was not a “black swan” and neither was the milk price collapse. Nassim Taleb, the modern originator of the black swan concept, and his collaborator, Mark Spitznagel, recently provided thought-provoking commentary that is useful for thinking about events that are likely to occur and hence unavoidable:

“Furthermore, some people claim that the pandemic is a ‘black swan,’ hence something unexpected, so not planning for it is excusable.

“The book they commonly cite is The Black Swan (by one of us). Had they read that book, they would have known that such a global pandemic is explicitly presented there as a ‘white swan’: something that would eventually take place with great certainty. Such an acute pandemic is unavoidable, the result of the structure of the modern world; and its economic consequences would be compounded because of the increased connectivity and overoptimization.”

For additional insight, follow this link: on.hoards.com/BailingOutNotYou, to read “Corporate Socialism: The Government is Bailing Out Investors & Managers Not You.”

Our take

In our view, dairy price collapses fall in the category of “something that would eventually take place with great certainty” and are an ongoing characteristic of the supply and demand dynamics within the dairy industry. Demand can disappear overnight for many different reasons and supply is typically slow to adjust. This mismatch in the supply response when demand disappears creates a price collapse.

Perishable commodities like milk often exaggerate the price collapse because options for storage are so limited and supply chains are so complex. This makes milk price collapses white swans.

Knowing these collapses will continue to occur does not provide any solace for those dumping milk in the present, and our hearts go out to those impacted by the situation. There are not always off-the-shelf solutions available, especially for supply chain and logistical risks. However, steps can be taken to cover price risk, and many producers have significantly reduced their price exposure during the pandemic with marketing tools such as dairy revenue protection (DRP) insurance.

Make preparations

What can you do about the next milk price collapse?

You cannot buy car insurance after a fender bender, and you cannot insure your barn after it is on fire. In the midst of this event, many dairy producers who consistently executed their marketing plan and purchased DRP are now insulated from the worst of the price collapse. They recognized the ongoing cyclical nature of the milk market, took steps to develop a plan, and executed that plan effectively.

Many producers have used contracting and hedging tools to manage risk as these tools became readily available over the last few decades. With the advent of DRP, dairy producers have a tool with a few advantages when it comes to insuring against a price and revenue collapse. DRP is unique in that it is lower cost and less cash flow intensive to implement than other tools.

It allows producers to establish a minimum revenue (or effectively a minimum price) for a subsidized premium that is about half paid for by the USDA Risk Management Agency. Furthermore, premiums are not due until after the protected period, so DRP allows for greater flexibility with timing of cash flows. These advantages have allowed many producers to protect up to 15 months into the future.

The good news is that tools like DRP can mitigate price risk and take advantage of opportunities in a dynamic market.

The keys to success are in implementation and execution:

- That means consistently buying tools such as DRP or Dairy Margin Coverage (DMC) far into the future and ahead of the unpredictable timing of a price collapse.

- Creating a plan that takes into consideration breakeven levels, how much a producer is willing to spend, and what is required to protect balance sheets to remain solvent is also critical.

- Finally, producers must stick with the plan, acknowledging that their unique plan may be different from their neighbor. Over the market cycle, these differences have some impact, but the most common variable for success is consistency. Only those who consistently apply protection are able to avoid the unpredictable timing of the price collapses.

Next steps

Risks have already materialized and the current environment is still plagued with uncertainty. Market volatility is very high with “limit moves” in both directions. Even in the midst of this chaos, it is still a good time to take steps to learn about DRP and include it in your risk management plan now and for the future.

We encourage you to get started. We are making our DRP Smart Quote tool available to those who wish to use it on a trial basis. Contact us at 800-884-8290 or by sign up for free access at on.hoards.com/SmartQuote.